Nota: Quando as alterações na margem da casa devido a alterações nas regras são indicadas em termos percentuais, a diferença é normalmente indicada aqui em pontos percentuais e não em percentagem. Por exemplo, se uma margem de 10% for reduzida para 9%, ela será reduzida em um ponto percentual, e não em dez por cento.

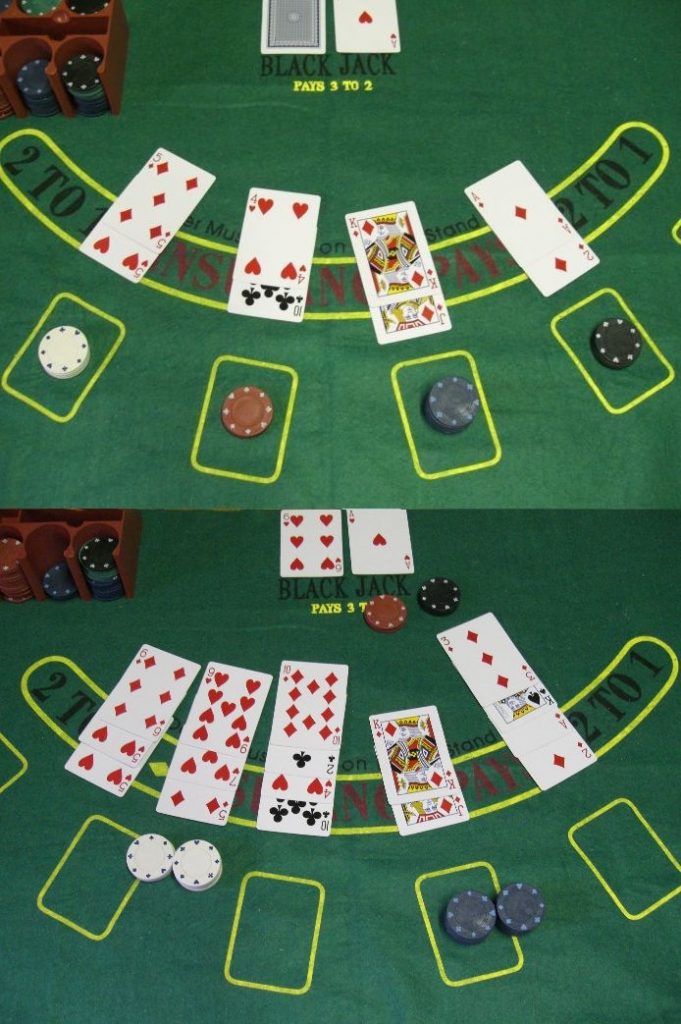

As regras do Blackjack são geralmente definidas por regulamentos que estabelecem variações de regras permitidas a critério do cassino. O Blackjack vem com uma “vantagem da casa”; a vantagem estatística do casino está incorporada no jogo. A maior parte da vantagem da casa vem do fato de que o jogador perde quando tanto o jogador quanto o dealer estouram. Os jogadores de Blackjack que utilizam estratégia básica perdem em média menos de 1% da sua acção a longo prazo, dando ao Blackjack uma das vantagens mais baixas do casino. A vantagem da casa para jogos em que o Blackjack paga 6 para 5 em vez de 3 para 2 aumenta cerca de 1,4%. Os desvios dos jogadores em relação à estratégia básica também aumentam a vantagem da casa.

Dealer acerta suave 17

Cada jogo tem uma regra sobre se o dealer deve acertar ou parar no soft 17, que geralmente está impresso na superfície da mesa. A variação em que o dealer deve acertar o soft 17 é abreviada como “H17” na literatura de blackjack, com “S17” usado para a variação stand-on-soft-17. Substituir uma regra “H17” por uma regra “S17” em um jogo beneficia o jogador, diminuindo a vantagem da casa em cerca de 0,2%.

Número de baralhos

Se todas as coisas forem iguais, usar menos baralhos diminui a vantagem da casa. Isto reflecte principalmente uma maior probabilidade de Blackjack do jogador, uma vez que se o jogador tirar um dez na sua primeira carta, a probabilidade subsequente de tirar um ás é maior com menos baralhos. Também reflete a diminuição da probabilidade de um Blackjack – Blackjack push em um jogo com menos baralhos.

Os casinos geralmente compensam endurecendo outras regras em jogos com menos baralhos, para preservar a vantagem da casa ou desencorajar completamente o jogo. Ao oferecer jogos de Blackjack de baralho único, os casinos são mais propensos a proibir a duplicação em mãos suaves ou após a divisão, restringir a nova divisão, exigir apostas mínimas mais elevadas e pagar ao jogador menos de 3:2 por um Blackjack vencedor.

A tabela a seguir ilustra o efeito matemático na borda da casa do número de baralhos, considerando jogos com várias contagens de baralhos sob o seguinte conjunto de regras: dobrar após a divisão permitido, dividir novamente para quatro mãos permitidas, não acertar ases divididos, sem rendição, dobrar em quaisquer duas cartas, as apostas originais são perdidas apenas no blackjack do dealer, o dealer acerta o soft 17 e a carta cortada é usada. O aumento na vantagem da casa por unidade de aumento no número de baralhos é mais dramático quando se compara o jogo de um baralho com o jogo de dois baralhos, e torna-se progressivamente menor à medida que mais baralhos são adicionados.

–

Rendição tardia/antecipada

A rendição, para os jogos que a permitem, geralmente não é permitida contra um Blackjack com dealer; se a primeira carta do dealer for um ás ou dez, a carta fechada é verificada para garantir que não haja Blackjack antes da oferta de rendição. Este protocolo de regras é, conseqüentemente, conhecido como rendição “tardia”. A alternativa, rendição “antecipada”, dá ao jogador a opção de se render antes que o dealer verifique se há Blackjack ou em um jogo sem cartas fechadas. A rendição antecipada é muito mais favorável ao jogador do que a rendição tardia.

No entanto, para a rendição tardia, embora seja tentador optar pela rendição em qualquer mão que provavelmente perderá, a estratégia correta é render-se apenas nas piores mãos, porque ter pelo menos uma chance em quatro de ganhar a aposta completa é melhor do que perder metade da aposta e empurrar a outra metade, o que implica a rendição.

Devido às limitações do capítulo, o restante conteúdo sobre “Variações de regras e efeitos na vantagem da casa” será colocado no próximo capítulo: “Variações de regras e efeitos na vantagem da casa —- Blackjack (Parte 2)”

Este artigo vem de Jogos do Paul.